Fintech Revolution: These 15 Startups Are Set to Change Southeast Asia Forever

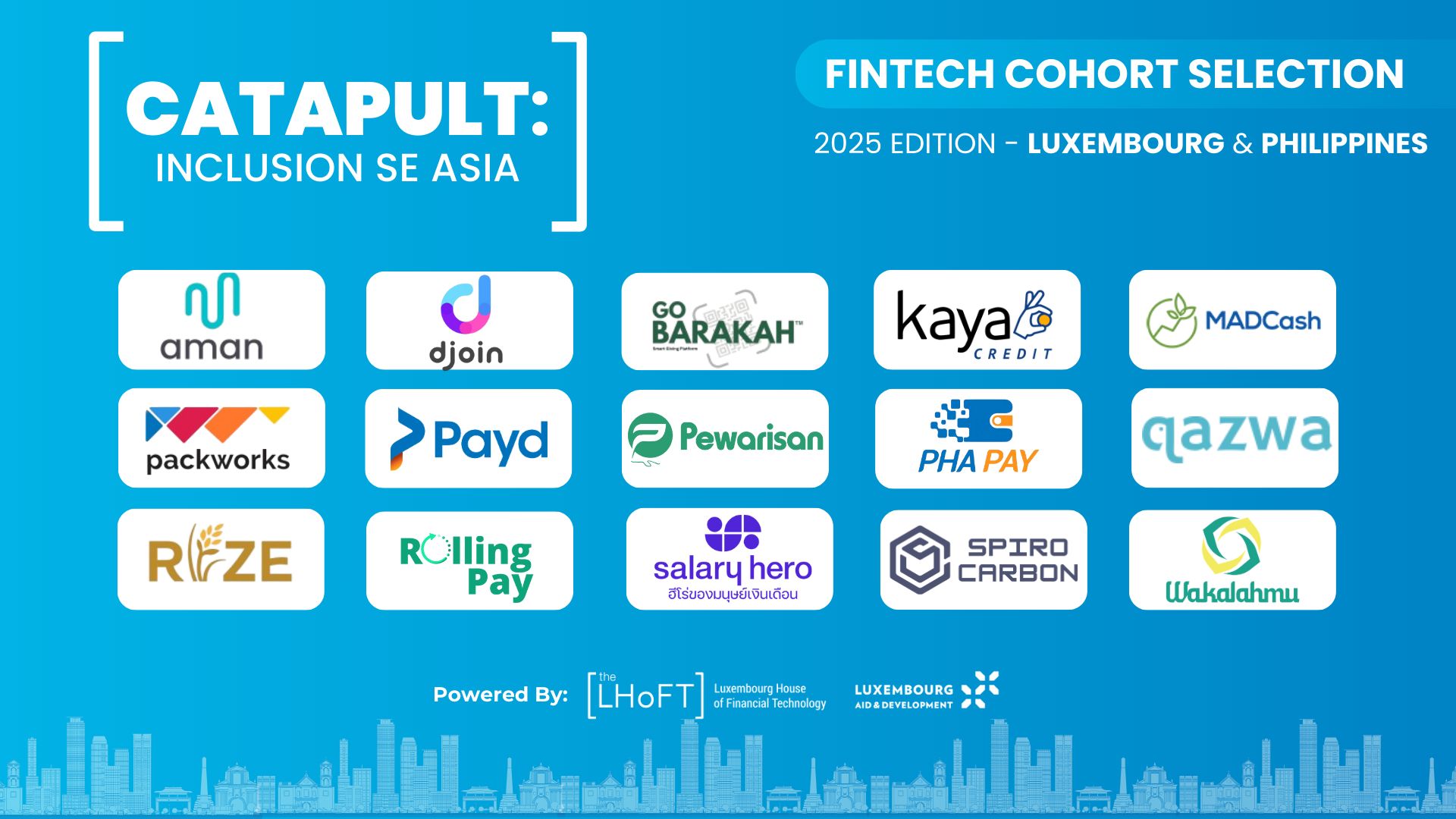

Luxembourg, May 6, 2025 — The financial inclusion landscape in Southeast Asia is about to get a major shake-up, as the Luxembourg House of Financial Technology (LHoFT) today announced the top 15 ASEAN fintech innovators selected for the prestigious Catapult: Inclusion Southeast Asia 2025 program.

Launched in partnership with the Directorate for Development Cooperation and Humanitarian Affairs of Luxembourg and the Asian Development Bank (ADB), the Catapult acceleration initiative supports the next generation of fintech startups driving financial inclusion, economic empowerment, and digital transformation in some of the world’s most underserved markets.

From providing microloans to empowering female entrepreneurs and introducing AI-driven solutions for credit unions, these 15 companies stand at the forefront of innovation, each addressing deeply entrenched barriers to financial access in the ASEAN region.

“This year’s cohort is solving real-world problems, not just digitizing convenience,” said a LHoFT spokesperson. “They are creating lasting impact where it’s needed most—among micro-entrepreneurs, rural workers, and underserved populations.”

🚀 Meet the Top 15 Fintech Champions of Inclusion

Each of the selected companies brings a unique solution that tackles a critical gap in their market. Here’s a breakdown of who they are and what they do:

- Aman – Delivers affordable health insurance solutions tailored for Indonesia’s underserved SMEs, bridging the healthcare access divide.

- Djoin ID – A game-changer in digital banking, offering AI-driven credit engines to empower credit unions with smarter, more inclusive lending.

- Gobarakah – Reinventing charitable giving by turning donations into traceable e-vouchers, ensuring transparency and digital traceability in philanthropy.

- Kaya Credit – Providing digital loans to MSMEs and FMCG retailers, this platform makes access to capital smoother and more data-driven.

- MADCash – Aimed at empowering women entrepreneurs, MADCash offers funds, business skills training, and performance tracking through a digital platform.

- Packworks – Equipping micro-retailers with essential digital tools, Packworks facilitates inventory management and generates valuable market insights for FMCG brands.

- Payd – A payroll innovation for casual labor, offering immediate payouts upon task completion—an essential tool for gig economy workers.

- Pewarisan Sdn Bhd – Revolutionizing legacy planning in Malaysia, Pewarisan prevents frozen assets through an accessible and affordable estate planning platform.

- PhaPay Co., LTD – Simplifies business operations by enabling seamless, automated payment integrations for small and medium enterprises.

- Qazwa Indonesia – Offers sharia-compliant peer-to-peer lending, connecting ethical investors to SMEs through Islamic financing principles.

- Rize – Tackling climate change, Rize reduces agricultural emissions using enhanced farming techniques and proprietary MRV (Measurement, Reporting, and Verification) technology.

- RollingPay – Provides halal, AI-driven credit for SMEs by converting daily sales into instant liquidity—ideal for cash-strapped businesses.

- Salary Hero – A platform to improve employee financial wellbeing by offering real-time salary access and financial literacy tools.

- Spiro Carbon Group – A climate-fintech company helping smallholder farmers tap into carbon markets through satellite technology and green financing.

- Wakalahmu – Pioneering Shariah-compliant insurance tech, making ethical insurance more accessible to Muslim communities.

🌍 From Luxembourg to the Philippines: A Journey of Impact

This year’s Catapult: Inclusion SE Asia kicks off in Luxembourg from June 16 to 20, 2025, where the selected fintechs will undergo a high-impact bootcamp. This week-long accelerator will focus on growth strategies, investment readiness, and social impact scaling—leveraging Luxembourg’s reputation as a top global fintech hub.

The journey doesn’t end there. After Luxembourg, the program transitions to Southeast Asia, culminating in the 5th Asia Finance Forum in the Philippines this September. This final phase will showcase the participants’ progress and connect them to regional stakeholders, investors, and policymakers.

“Our mission is to promote sustainable development by combining Luxembourg’s financial expertise with local innovation,” said a representative from the Luxembourg Directorate for Development Cooperation. “The results are tangible, lasting, and deeply human.”

🌱 A Movement Toward Inclusive Prosperity

The Catapult program is more than an accelerator—it’s a catalyst for inclusive prosperity. In regions where access to financial tools is uneven, these startups are bridging the gap and enabling millions to enter the formal economy.

A recent ADB report emphasized that over 70% of adults in Southeast Asia still lack access to essential financial services, highlighting the urgency and relevance of initiatives like Catapult. From Malaysia to Indonesia to the Philippines, these fintechs are stepping up to redefine how finance works for the everyday person—not just the elite.

📣 What’s Next?

With Catapult: Africa and Catapult: Green Fintech also opening applications, LHoFT and its partners continue to extend their impact globally. The momentum from the Southeast Asia program is expected to create cross-regional synergies and attract more investment into mission-driven fintech solutions.

Interested in following the journey or applying for the next Catapult program?

🔗 Visit: https://shorturl.at/jvSpA

As the 2025 cohort prepares to launch their innovations in Luxembourg this June, one thing is clear: the future of fintech in Southeast Asia is bold, inclusive, and just getting started.